Extinction and discharge of mortgages

Extinction of mortgages

The mortgage is terminated:

- by the loss of the charged property, a change in its nature, its withdrawal from commerce or its expropriation, where those events concern the property as a whole1

- by the extinction of the obligation whose performance it secures,2 in other words by the repayment or prescription of the debt

- in the case of a movable mortgage, 10 years after the date of its registration3

- the pledge is extinguished upon termination of detention4

- in the case of an immovable mortgage, not later than 30 years after the date of its registration5

- in the case of a legal mortgage of a syndicate, three years after it is registered6

A deed of discharge is the appropriate way to cancel an existing mortgage.

Cancellation of mortgage

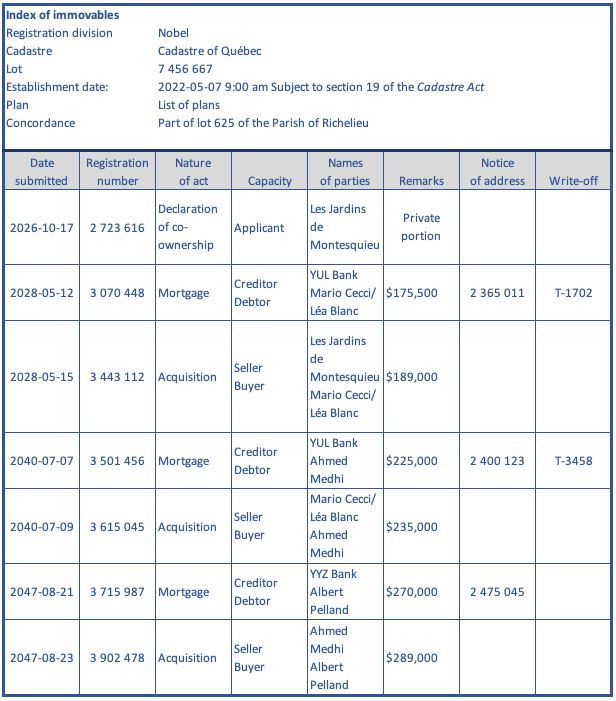

A mortgage can be cancelled by the signing of a document, by the court or by the passage of time. It is important for the broker to know whether or not a mortgage entered in the Land Register has been cancelled. The Index of Immovables will show a cancellation number opposite the reference to the mortgage.

The cancellation can be the result of one of the following four events.

Discharge7

A discharge is a written statement in which a creditor declares that he has received full or partial payment of the debt (the amount of the loan that is ancillary to the mortgage) owed by its debtor. It is said to be total when payment is complete and the debtor no longer owes anything to the creditor. It is said to be partial when payment is incomplete and the debtor still owes part of the debt.

Release8

This is a written document in which the creditor agrees to cancel the mortgage, even if the mortgage has not been repaid by the debtor.

Judicial cancellation9

Judicial cancellation is when the striking of the mortgage from the Land Register or the Registre des droits personnels et réels mobiliers is ordered and the result of a decision by the court.

Expiration10

It is the passage of time and the failure of the creditor to exercise a mortgage right before the expiry of the time limit that puts an end to the mortgage. An immovable mortgage becomes prescribed 30 years after it is entered in the Land Register, and a movable mortgage becomes prescribed after 10 years.

► DUTIES AND OBLIGATIONS OF THE BROKER

Rules surrounding the discharge of a mortgage

When the immovable being sold is charged with a mortgage, the seller’s broker must inform his client of the following:

- that he must ask his notary to obtain a discharge or release from the creditor;

- that he must pay the notary fees.

To ensure the security of real estate transactions for all parties involved, notaries are subject to strict rules regarding requests for statements of account in connection with the repayment of a credit balance leading to the cancellation of a mortgage on an immovable. These days, clients have access to several types of credit that can be secured by immovable mortgages. Faced with this diversity, mortgage creditors have issued directives stating that they will refuse to release the immovable from the mortgage if the seller does not remit the sums due for all the loans or credits granted and secured by the immovable concerned. We can already see the potential impact on a property transaction, especially if it is a link in a chain of transactions.

For an example and more details, read the article Why mortgage statement? Rules surrounding the discharge of a mortgage.

1 S. 2795 C.C.Q.

2 S. 2797 C.C.Q.

3 S. 2798(1) C.C.Q.

4 S. 2798(2) C.C.Q.

5 S. 2799 C.C.Q.

6 S. 2800 C.C.Q.

7 S. 3065 C.C.Q.

8 S. 3059 C.C.Q.

9 S. 2965, 3057.1 and 3061 C.C.Q.

10 S. 3058 and 3059 C.C.Q.