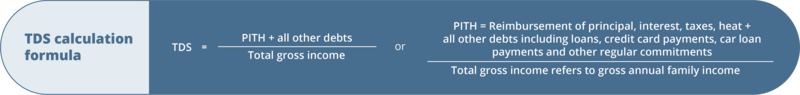

Total debt service (TDS)

Mortgage lenders also want to know what payments the borrower must make to repay other debts, such as:

- bank and other loans

- credit card payments, usually an estimated 4% of the outstanding balance

- 3% of the limit of a personal line of credit

- car loan payments

- personal loans from a family member or other private lender

- any other regular commitments, including alimony payments

The total debt ratio takes into account all the borrower’s debts.

Generally speaking, lenders accept a maximum TDS ratio of 40% for conventional loans and 44% for insured loans. In other words, only 40% or 44% of the borrower’s eligible gross income can be devoted to PITH payments and all other debts. Here, the limit is based on practice and institutional policies, as well as on the insurer’s standards (e.g. CMHC).

Example of TDS calculation.

Mortgage payments (principal and interest): $1,100 per month

Taxes: $100 per month

Heating: $75 per month

Monthly income: $4,500

Credit card payments: $550 per month

Car loan payment: $450 per month

How is TDS calculated?

This gives a percentage (x 100) de 50.55%.

► DUTIES AND OBLIGATIONS OF THE BROKER

Since the TDS is greater than 40%, the client would not qualify for a conventional mortgage using this measure alone.

In such a case, the broker must recommend that the client consult a professional (financial institution, mortgage broker, lawyer, etc.) for personal financial advice.