Interest rate amortization or repayment plan

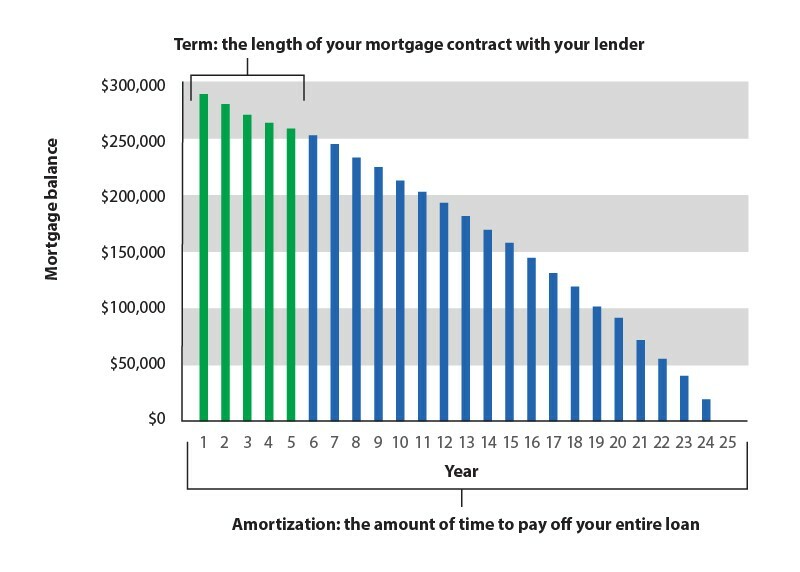

A mortgage contract usually has a maximum term of five years, but the total repayment of the loan is calculated over a much longer period.

The duration of the mortgage contract is called the “term.” The conditions attached to the loan, such as the applicable interest rate and payment frequency, are fixed for the duration of the term.

At the end of each term, the buyer can choose a new term and negotiate the duration, interest rate and payment frequency with his current lender or with a new lender. In the event of a change of lender, the borrower must go before the notary again.

The amortization period is the total time required to repay the entire amount borrowed, including accrued interest.

The following figure shows the amortization of a $300,000 mortgage. As we can see, several terms are required in this case.

The interest rate has a major impact on the total amount paid at the end of the amortization period, which in turn has an impact on the scheduled payments.

Example: $300,000 loan over 25 years

Interest rate / Monthly payment — 2.5% ⇒ $1,344

Interest rate / Monthly payment — 5.2% ⇒ $1,779

The amortization period has a major impact on the total amount paid by the buyer before the loan is fully paid off. The final amount will be lower for a shorter amortization period, as interest accrues for a shorter period of time.

Example: $300,000 loan at a 4% interest rate

Amortization period / Total interest paid — 10 years ⇒ $64,000

Amortization period / Total interest paid — 25 years ⇒ $173,000

However, a shorter amortization period means the buyer must make higher payments.

Example: $300,000 loan at a 4% interest rate

Amortization period / Monthly payment — 10 years ⇒ $3,033

Amortization period / Monthly payment — 25 years ⇒ $1,578

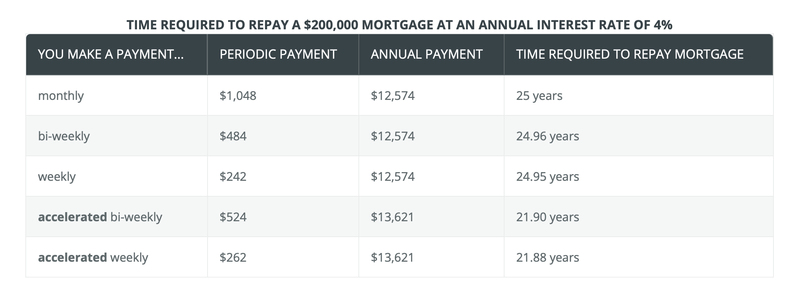

The frequency of payments has an impact on the amortization period. A higher payment frequency, known as accelerated repayment, means the loan is repaid more quickly.

Important! The simple fact that a client is making bi-monthly or weekly payments does not mean that the loan is being repaid on an accelerated basis.

Example: Monthly payment of $2,000

Regular bi-monthly calculation method: 2,000X12/26 = $903.07 per payment.

Accelerated bi-monthly calculation method: 2,000/2 = $1,000 per payment.

Source: AMF